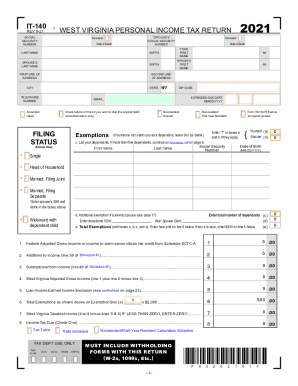

WV DoR IT-140 2022-2024 free printable template

Get, Create, Make and Sign

Editing it 140 wv online

WV DoR IT-140 Form Versions

How to fill out it 140 wv 2022-2024

How to fill out it 140 west virginia:

Who needs it 140 west virginia:

Video instructions and help with filling out and completing it 140 wv

Instructions and Help about west virginia 140 form

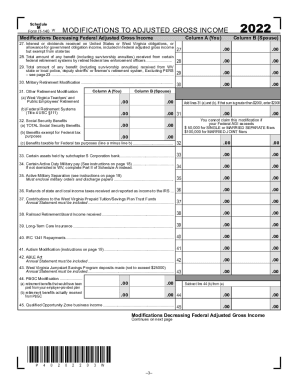

Hi I'm mark for attacks calm the state of West Virginia taxes its residents at the following rates regardless of filing status up to ten thousand dollars at three percent ten thousand one dollar to twenty-five thousand dollars at four percent 25000 one dollar to forty thousand dollars at four point five percent forty thousand one dollar sixty thousand dollars at six percent 60000 one dollar and above at six point five percent West Virginia taxes Social Security benefits to the same extent that they are taxed by federal taxes West Virginia starts the tax based on your adjusted gross income West Virginia taxes items such as distributions from IRAs pensions and social security for the amount of the adjusted gross income that is taxed federally if you're 65 years and older you may exclude up to the first eight thousand dollars from state taxes and up to sixteen thousand dollars if married filing jointly if you receive your pension from another state you also qualify for the exemptions if you are resonant you may exempt up to two thousand dollars from state or civil pensions you can be exempt from West Virginia's personal income tax with a family tax credit if you qualify based on income limits residents are any person who is physically in West Virginia or who maintains an abode in state for greater than those 183 days during the tax year is considered a resident you don't have to have one hundred eighty-three consecutive days to be a resident there is also a possibility that you can be considered an actual resident of West Virginia and have a domiciliary in another state a good example of this is a student who stays in West Virginia during the school year but resides in another state most domiciliary residents do live in West Virginia there are some exceptions to this where you may be a domiciliary resident but not live in West Virginia examples are a student that is attending school in another state but maintains the legal residence in West Virginia a residence who is working in another country but does not abandon their current domicile and military personnel who are out of state and do not forfeit their residency for more information visit attacks calm

Fill wv form it 140 : Try Risk Free

People Also Ask about it 140 wv

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your it 140 wv 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.