WV DoR IT-140 2024-2026 free printable template

Show details

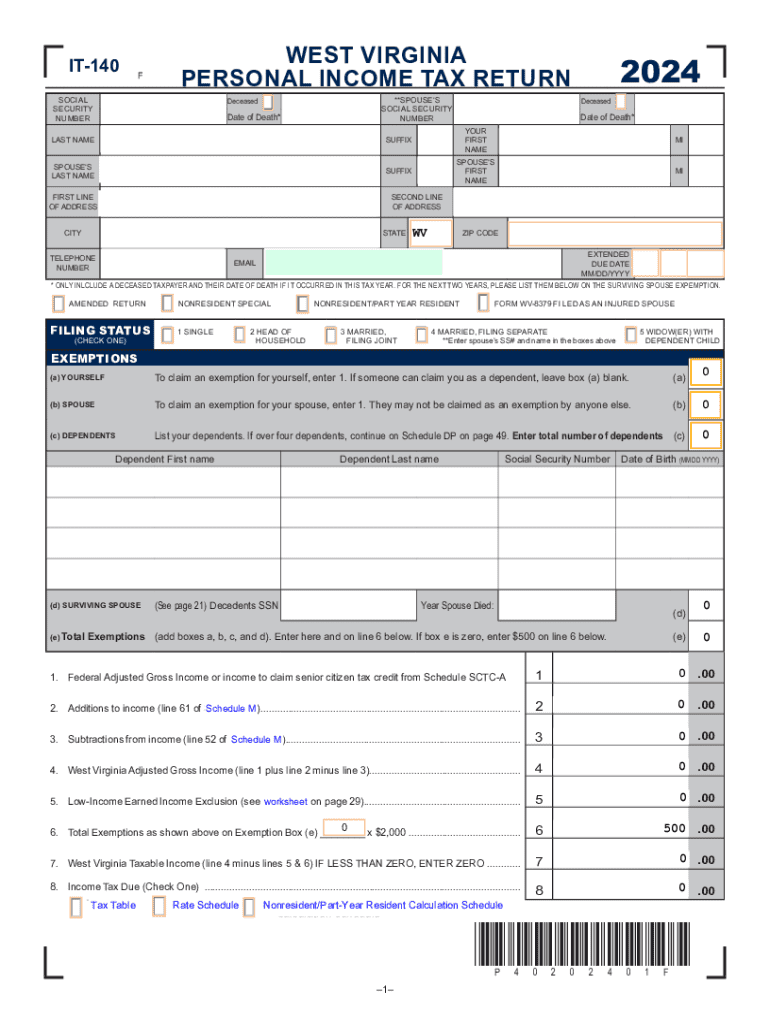

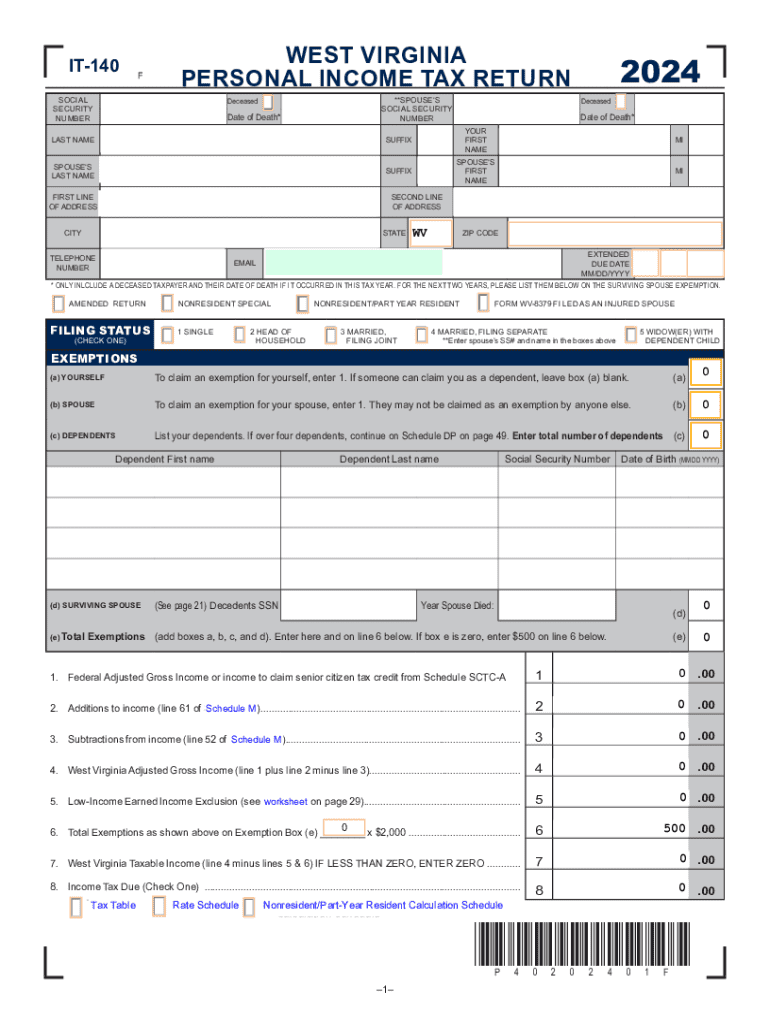

TOTAL AMOUNT DUE LINE 9 Enter total State Use Tax due from line 3. total here and on line 13 of Form IT 140. Wvtax. gov. This is the fastest way to pay your balance due. If you send a check or money order write your social security number and 2024 Form IT 140 on it. Clear All Values IT-140 Print Your Return Check Your Return for Required Information F SOCIAL SECURITY NUMBER WEST VIRGINIA PERSONAL INCOME TAX RETURN Deceased Date of Death SPOUSE S SOCIAL SECURITY LAST NAME SUFFIX YOUR FIRST...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form it 140

Edit your wv state tax form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wv it 140 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it 140 fillable west virginia online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wv state tax form fillable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV DoR IT-140 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wv state tax form it 140 pdf

How to fill out WV DoR IT-140

01

Obtain the WV DoR IT-140 form from the West Virginia Division of Revenue website or a local tax office.

02

Enter your personal information at the top, including your name, address, and Social Security number.

03

Fill out the income section by reporting all sources of income as required.

04

Complete the deduction and credit sections as applicable.

05

Calculate your total tax due or the amount of your refund.

06

Review all entries for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form by mail or electronically if available.

Who needs WV DoR IT-140?

01

Individuals who earn income in West Virginia and are required to file a state income tax return.

02

Residents of West Virginia who need to report their income to the state's tax authority.

03

Taxpayers seeking to claim deductions or credits against their West Virginia income taxes.

Fill

wv state tax form

: Try Risk Free

People Also Ask about form it 140

What is an IRS Form 140?

01/01/2005. Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona. You must use Form 140 if any of the following apply: Your Arizona taxable income is $50,000 or more, regardless of filing status.

What forms do I need to file quarterly taxes?

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Do you have to make estimated quarterly tax payments?

For estimated tax purposes, a year has four payment periods. Taxpayers must make a payment each quarter. For most people, the due date for the first quarterly payment is April 15. The next payments are due June 15 and Sept.

How do I pay my quarterly taxes 2022?

The remaining deadlines for paying 2022 quarterly estimated tax are: June 15, September 15, and January 17, 2023.These include: Direct Pay from a bank account. Paying by credit or debit card or the Electronic Federal Tax Payment System. Mailing a check or money order to the IRS. Paying cash at a retail partner.

What is WV it 140 form?

What is WV it 140? Use the IT-140 form if you are: A full-year resident of West Virginia. A full-year non-resident of West Virginia and have source income (mark IT-140 as Nonresident and complete Column C of Schedule A) Considered a part-year resident because you moved into or out of West Virginia.

How do I pay my taxes quarterly?

How to pay quarterly taxes You can submit them online through the Electronic Federal Tax Payment System. You can also pay using paper forms supplied by the IRS. When you file your annual tax return, you'll pay the balance of taxes that weren't covered by your quarterly payments.

Does the IRS send a form for estimated tax payments?

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

What form do I use to pay quarterly taxes?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

How do I pay quarterly taxes in WV?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

How do I pay 2022 quarterly taxes?

The remaining deadlines for paying 2022 quarterly estimated tax are: June 15, September 15, and January 17, 2023.These include: Direct Pay from a bank account. Paying by credit or debit card or the Electronic Federal Tax Payment System. Mailing a check or money order to the IRS. Paying cash at a retail partner.

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Who has to file a WV tax return?

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia. How do I request a refund?

Can I pay my quarterly taxes all at once?

Many people wonder, “can I make estimated tax payments all at once?” or pay a quarter up front? Because people might think it's a nuisance to file taxes quarterly, this is a common question. The answer is no.

Does West Virginia require estimated tax payments?

You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent of your estimated tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find wv it 140?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the wv state tax form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit it 140 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your wv state tax form it 140 2025 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out wv state tax form it 140 2024 using my mobile device?

Use the pdfFiller mobile app to fill out and sign wv form it 140. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is WV DoR IT-140?

WV DoR IT-140 is a form used by residents of West Virginia to file their personal income tax returns.

Who is required to file WV DoR IT-140?

Residents of West Virginia who earn income and are subject to state income tax are required to file WV DoR IT-140.

How to fill out WV DoR IT-140?

To fill out WV DoR IT-140, individuals must provide personal information, report their income, claim deductions and credits, and calculate their tax liability on the form.

What is the purpose of WV DoR IT-140?

The purpose of WV DoR IT-140 is to report income earned during the tax year and determine the amount of state income tax owed to West Virginia.

What information must be reported on WV DoR IT-140?

The information that must be reported on WV DoR IT-140 includes personal identification details, income sources, deductions, credits, and the overall tax calculation.

Fill out your WV DoR IT-140 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wv Dor is not the form you're looking for?Search for another form here.

Keywords relevant to west virginia tax forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.